Senate Approves Final Budget Reducing Tax Burden by $1 Billion with Flat Tax and Property Tax Relief

The Ohio Senate approved the state's new Biennial Operating Budget maintaining the Upper Chamber's commitment of fiscal responsibility to the taxpayers.

"Our constitutionally balanced budget represents an historic investment in the people of Ohio," said Senate President Rob McColley. "Taxes are kitchen table issues for every family, and I'm pleased we completed the mission of substantial property tax and income tax relief."

The Senate and House worked through the points of difference between each chamber's "as passed" version of the budget in an efficient and effective manner over the last week.

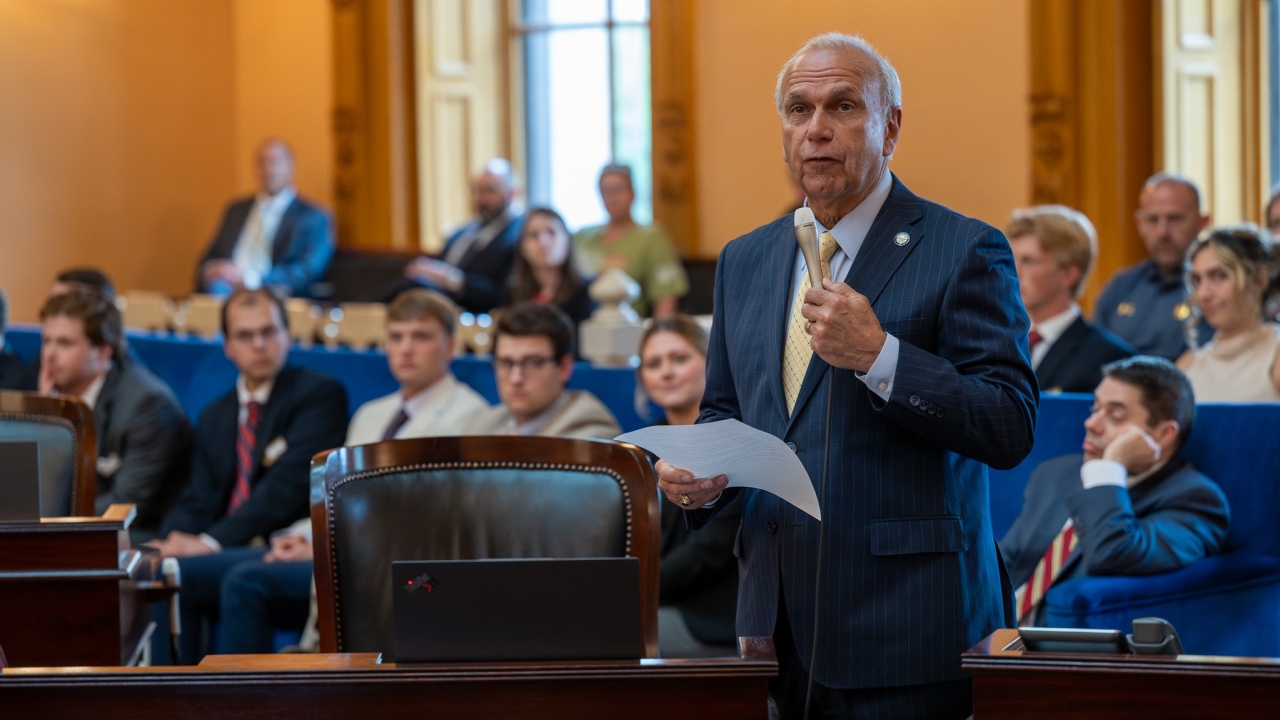

"I am very pleased with the professionalism and good faith negotiations with our colleagues in the House," said Senate Finance Chairman Senator Jerry Cirino. "This budget continues to build the foundation for strong economic growth here at home, because a healthy economy equals a healthy Ohio."

Reducing Income Tax Burden with Fair Flat Tax

Over the last decade the Republican Senate has prioritized reducing the income tax burden on Ohioans. The Senate reached a milestone in the new Operating Budget by building on that progress with the implementation of a flat income tax.

The 2.75% flat rate will take effect in tax year '26, while tax year '25 will also see an immediate reduction of the highest bracket, which will drop from 3.5% to 3.125%.

"The first thing moms and dads see on payday is the often disappointing amount of taxes taken out of their hard work," said President McColley. "I'm proud of the progress we have been able to make over the last decade by reducing the overall number of income tax brackets from nine down to one."

Anyone making $26,050 or less will pay ZERO state income tax.

Acting with Meaningful Property Tax Reform

Ohio homeowners hit with troubling property tax increases have been adamant about the General Assembly modernizing the property tax system and improving local tax transparency.

Over the last forty years, revisions have weakened the anti-inflationary guardrails as originally intended. Among them are emergency and replacement levies that skirted those guidelines.

"There is no excuse for retirees who worked hard to pay off their homes to ever have to worry about losing their homes because of skyrocketing property taxes," said Senate President McColley.

The budget will abolish any new emergency or new replacement levies and require improved rules and plain language for future ballot issues to provide more transparency for voters when considering levy requests.

The Senate also recognized the importance of maintaining home rule and local control on property tax matters by enhancing the role of County Budget Commissions.

Budget Commissions consist of the local elected county prosecutor, auditor, and treasurer, and the budget empowers the commission to review and even reduce the financial impact on property owners.

School districts will be permitted to maintain a 40% surplus for their operating budget carryovers year to year, with an allowance for capital projects, but any excess will have to be returned to the taxpayers. Collectively Ohio's 611 districts amassed a $10.5 billion cash carryover last year. "This needed to be addressed," noted Chairman Cirino.

Nearly $1 Billion More for K-12 Public Schools

The operating budget builds on the historic investments over the last two budgets that poured more than an additional $3 billion into public education.

This budget adds nearly a billion dollars more into Ohio's public schools.

Every district will receive at least the same amount as FY '21.

77% of districts will receive an increase over what they received in FY '25 in the first year of the budget, and 75% of districts will receive an increase in the second year compared to FY '25.

Districts will also receive additional state aid for significant academic improvement as well as those that have received a 4-to-5 Star rating from the Department of Education and Workforce.

"We want all children to have the opportunity to reach their God given potential," said President McColley. "Results matter, and we want to reinforce that message by recognizing the importance of performance in public schools."

The Senate encourages parents to get involved in their schools, and believes that more information is better, especially for voters. That is why, the budget will require candidates for school board races to have their political party affiliation designated on the ballot.

Visionary Economic Development Driver Coupled with Professional Sports

Ohio is uniquely positioned to capitalize on the economic power professional sports brings to our state.

The budget maintains the Senate's unique plan to leverage $600 million in unclaimed funds that have been sitting idle for decades to provide a performance grant for Brook Park's economic development project.

The project would build a mixed use economic development around the centerpiece of a new domed stadium for the Cleveland Browns. This will be the only domed stadium in Ohio.

This strategy protects state tax dollars and the state's credit rating because the project does not involve the state backing bonds for the development which would commit tax dollars toward interest payments over the life of the bonds. This would have accumulated to more than $400 million over the course of 25 years.

"We project that the state will actually receive a return on its investment," said Chairman Cirino. "Every four years the Brook Park project will be evaluated against incremental tax revenue forecasts, and any shortfall will be covered by the Cleveland Browns organization through an escrow amount of $100 million."

People who believe they are owed money from Unclaimed Funds will have an additional decade to file a claim through the Department of Commerce.

Investment In Higher Education and Academic Freedom

The General Assembly established five centers of civics and government as part of the prior budget.

The Centers located at Wright State University, Miami University of Ohio, Ohio State University, Cleveland State University, and The University of Toledo have been well received in their mission of promoting intellectual diversity and civics education.

Watch a recent President's Podcast with two professors from Ohio State and Chairman Cirino about the benefits of these vital programs

The budget fully funds the operating needs of all five centers with $34 million over the biennium. They operate independently from their host campuses, and focus on delivering courses and curricula based on critical thinking and thoughtful debate.

Investing in Families, Housing, and Childcare

The budget increases the Senate's $100 million investment at addressing a shortage of housing in Ohio.

The REDD program will invest $25 million for Residential Economic Development Districts which will help plan for and provide homes for a rapidly growing workforce in Ohio's metropolitan areas that were selected for mega development sites.

$100 million will be directed into a revolving loan fund that will help prepare sites in rural Ohio for infrastructure and housing construction.

Often the geography and lack of site ready areas in rural Ohio makes larger scale housing plans unaffordable for developers compared to places located near larger cities.

The Senate's commitment to Ohio's families continues with a $20 million investment for Ohio's Fatherhood Commission which will run the Responsible Fatherhood Initiative.

Recently national leaders joined President McColley to support the effort to address the startling statistic that 53% of Ohio's children live in single parent homes.

"We know that children living without both parents are much more at risk of living in poverty," said President McColley. "We know that dads provide stability at home, and this program is vital in teaching young men, who grew-up without a father, how to be an active and involved father."

As Ohio's workforce continues to expand five years after COVID, there is a need now more than ever for access to childcare.

The new budget maintains the General Assembly's commitment to childcare, allocating more than $100 million for the Choice Voucher Program that supports families earning up to 200% of the Federal Poverty Level(FPL).

The budget also increases funding by 19% for early childhood education which provides educational services for children who are at least three but too young for kindergarten.

Families earning up to 200% of the FPL qualify for the program, and the investment totals $260 million.

Growing Ohio's Economy By Reducing the Bureaucracy Burden

Ohio's $60.23 billion budget is balanced as required by the Constitution and includes more than $1 billion in tax relief to Ohioans.

It reflects the kitchen table common sense that says the way to grow an economy and a budget, is by reducing the burden of bureaucracy that comes with higher taxes and regulations.

Over the last several budgets, reducing the tax burden has resulted in economic growth and additional revenue for the state.

Consumer spending represents two-thirds of the economy, and when the people have more discretionary income for their families, Ohio becomes a great place to live, work, and raise a family.

This week Senate President Rob McColley and Senate Finance Chairman Jerry Cirino join the President's Podcast. They deliver insight and perspective about the budget process as well as the first six months of the 136th General Assembly that delivered ground breaking reforms for higher education and energy policy for generations to come.