Solving Ohio's Housing Crisis

Solving Ohio's Housing Crisis

A Comprehensive Approach for Homeowners, Renters, and Businesses

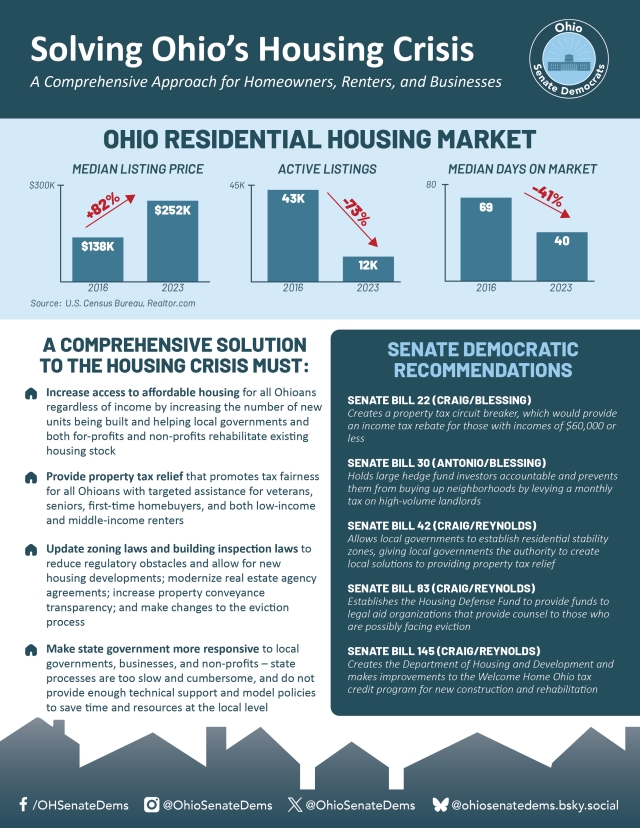

The state of Ohio is facing a severe housing crisis. Some urban cities are struggling with rapid expansion, while some rural counties are combatting economic decline. Our inadequate housing supply and lack of new developments create an unsustainable future for Ohio. As we begin this General Assembly, there is a housing gap of over 260,000 units. Personal and business bankruptcy filings are increasing while policy changes in Washington threaten huge cuts in federal support for housing programs and other programs that support struggling Ohioans.

HOW DID WE GET HERE?

Republican efforts to address the housing crisis have been anemic and may be too little, too late. Over 20 years of Republican income tax cuts and tax shifting away from businesses onto working Ohioans have been accompanied by cuts in state property tax “rollbacks” (the state’s share of local property taxes) and funding cuts for local governments whose allocation of major state tax revenues through the Local Government Fund has been reduced by almost two-thirds.

All levels and forms of government in Ohio are funded primarily by a combination of income, sales, and property taxes. The percentage of property taxes of total state and local taxes has been steady for the last several decades. However, the era of excessive Republican income tax cuts for wealthy Ohioans and other tax cuts such as the “LLC Loophole” have significantly increased financial pressures on local governments and reduced the share of property taxes paid by businesses – putting more financial pressure on homeowners and renters who pay their landlords’ taxes.

Legislative committees have done extensive work to study housing and property taxes, but there has not been the will to act. Last session of the General Assembly, over 10 Senate bills to address the housing crisis were introduced, but Republican infighting resulted in legislative deadlock and no relief for Ohioans desperately in need of quality, affordable housing.

WHAT CAN WE DO?

Solving Ohio’s housing crisis must be part of a broader solution that addresses the high cost of living, drastic increases in property taxes, the housing shortage (rentals and owner-occupied), access to good-paying jobs, and school funding (which still unconstitutionally over-relies on local property taxes two decades after the DeRolph decisions). A comprehensive solution will allow all Ohioans to live in safe and healthy communities. Workers need affordable housing near their jobs. Failure to address the housing crisis imperils our future economic development and the strength of our schools and local governments. If businesses and their workers do not have access to affordable housing, they will not expand their operations, not consider coming to Ohio, or leave for other states.

SENATE DEMOCRAT RECOMMENDATIONS

We believe that a comprehensive solution to the housing crisis must do the following:

- Increase access to affordable housing for all Ohioans regardless of income by increasing the number of new units being built and helping local governments and both for-profits and non-profits rehabilitate existing housing stock

- Provide property tax relief that promotes tax fairness for all Ohioans with targeted assistance for veterans, seniors, first-time homebuyers, and both low-income and middle-income renters

- Update zoning laws and building inspection laws to reduce regulatory obstacles and allow for new housing developments; modernize real estate agency agreements; increase property conveyance transparency; and make changes to the eviction process

- Make state government more responsive to local governments, businesses, and non-profits – state processes are too slow and cumbersome, and do not provide enough technical support and model policies to save time and resources at the local level

We need to act on legislation this session to help keep people in their homes and increase access to affordable housing. So far this session, Senate Democrats have introduced several bills that would help address the housing crisis:

- S.B. 22 (Craig/Blessing) – Creates a property tax circuit breaker, which would provide an income tax rebate for those with incomes of $60,000 or less

- S.B. 28 (Antonio/Blessing) – Holds large hedge fund investors accountable and prevents them from buying up neighborhoods by levying a monthly tax on high-volume landlords

- S.B. 42 (Craig/Reynolds) – Allows local governments to establish residential stability zones, giving local governments the authority to create local solutions to providing property tax relief

- S.B. 83 (Craig/Reynolds) – Establishes the Housing Defense Fund to provide funds to legal aid organizations that provide counsel to those who are possibly facing eviction

- S.B. 145 (Craig/Reynolds) – Creates the Department of Housing and Development and makes improvements to the Welcome Home Ohio tax credit program for new construction and rehabilitation

Our Senators are also considering legislation to expand the homestead exemption, protect seniors by freezing property taxes for qualifying homeowners 65 years old and older, allow homeowners to defer their taxes until they sell their homes, and make sure our workers and families have places to live. As the state budget proceeds, we will advocate for policies that invest state funding to expand proven programs such as the Ohio Housing Trust Fund and improve existing programs that show great promise such as the Welcome Home Ohio Program. We also need to creatively expand how we use tax credits to incentivize investors to build new houses and apartments and renovate existing housing.

The Ohio Senate Democratic Caucus believes we all need to work together – all levels of government with our private and non-profit partners – to immediately provide support for Ohioans who cannot find affordable housing, those at risk of losing their housing, and communities and businesses who cannot expand or prosper.